Retail 101 Part 3: The Value of Customer Lifetime Value

1st June 2023

It’s just as important to keep your existing customers as it is to acquire new ones. In part 3 of our Retail 101 series, we will be focusing on customer lifetime value, by understanding the long-term worth of your customers through the value analysis of data.

Having a comprehensive understanding of each customer and actively evaluating their lifetime value enables companies to effectively determine the right approach to customer segmentation. If you’re interested to know more, read our previous guide.

First thing first, what is customer lifetime value and why is it important?

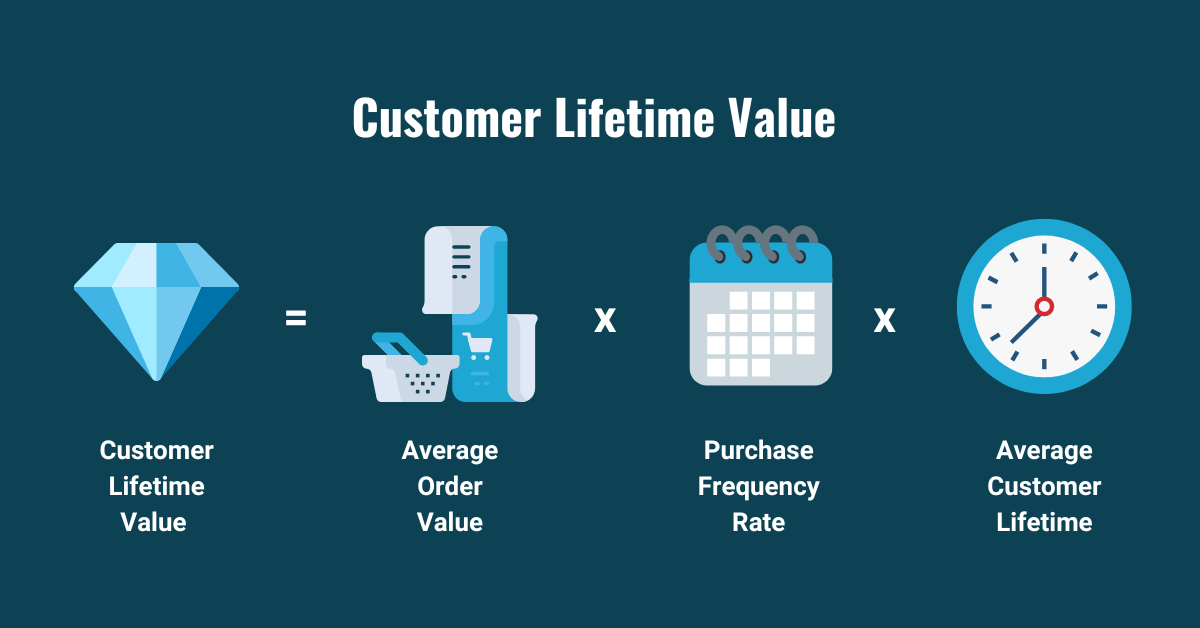

The customer lifetime value (CLV) indicates the total revenue a business can reasonably expect from a single customer throughout the business relationship.

CLV is important to organisations because it gives you the power to harness the value of each customer during the buyer’s journey. CLV is utilised to increase customer loyalty, reduce churn and for making strategic business decisions aligned to meet customer needs.

The longer a customer continues to purchase from a business, the greater their lifetime value becomes. Plus, CLV helps with budgeting as you can confidently set budgets for customer acquisition and retention costs.

Today’s market is customer-centric, that’s why it’s essential to understand customer lifetime value. It helps businesses to concentrate their further activities around their most profitable clients. How to measure customer lifetime value is shown below:

The better a business understands the customer lifetime value, the better they will succeed in retaining its customers. For example, take a look at ClarityOmnivue, CLV has only highlighted the importance of knowing your customers at a personal level, ClarityOmnivue takes this to a hyper personalised level, enabling you to target customers with tailored products and experiences.

How does Data Improve the Customer Lifetime Value?

Prioritise your High Value Customers

Your most valuable customers are those who consistently purchase your products at full price, make multiple purchases overtime, and have a higher average order value compared to the median. To keep it short, these customers will bring in more business in the long run, and will possess a naturally higher customer lifetime value.

By gaining a deep understanding of the DNA of your high-value customers and analysing their behaviour throughout the sales life-cycle, will allow you to identify key attributes that indicate similar behaviour among your prospects – effectively targeting and engaging potential customers.

Identifying high-value customers involves analysing multiple facets of data, including:

- Historical sales data

- Customer feedback and reviews

- Market research insights

Data is the foundation of personalisation to unlock retention

Many brands and organisations know all about their customers over time, tailoring services, and support accordingly. With COVID-19 and the surge in digital behaviours raising the bar, did you know three-quarters of consumers switched to new product or buying methods during the pandemic? A staggering 71% of consumers today expect companies to deliver personalised interactions, evidenced by Mckinsey.

A complete set of data provides the whole picture, and a single view of each individual customer – laying the foundation for effective personalisation. This set of data talks more about your target audience, and establishes the means to acquire them through personalised content. This data can be segregated into categories:

- Demographic: Age, income, gender, location, interests

- Behavioural: Customers’ behaviour to businesses in your industry and their reactions to your marketing advertisements

- Transactional: Purchase history, how much they are likely to spend, purchasing decisions

- Financial: Cost of investing and selling, customer profitability and ROI.

By harnessing this information, you can enhance their interaction with you and foster long-term customer loyalty.

Data Drives Better Customer Service

To improve customer service, you must use data effectively. Data can be used to improve the decision-making process within customer service teams, and when analysed properly, data lets you predict what customers want even before they want it.

If a customer engages with your service representative, they can quickly access the customer’s profile and provide the relevant support. Data also helps prevent missing customer communications, enabling your team to swiftly address any concerns and provide efficient resolutions.

By swiftly and efficiently addressing customer inquiries, you establish your business as a trusted and dependable entity in the market. This contributes to enhanced CLV.

If you’ve missed any of these blogs from our Retail 101 series, catch up here:

Part 1: Know and reach your customers with segmentation

Part 2: Gather a single, accurate view of your customer

Part 3: The value of customer lifetime value

Part 4: Exploring the Dynamics between Product and Customer Loyalty

If you’d like to be reminded when new blog posts are published, follow us on LinkedIn.